UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

☒ Filed by a Party other than the Registrant ¨

☐

Check the appropriate box:

| ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the CommissionOnly (as permitted by Rule 14a-6(e)(2)) | |

Rule 14a-6(e)(2))

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting | |

S&P Global Inc.

McGraw Hill Financial, Inc.

(Name of Registrant as Specified In Its Certificate)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

| ☒ | No Fee Required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(4) and0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Notes:

Reg. §240.14a-101.

SEC 1913 (3-99)

55 Water Street

New York, NY 10041-0003

March 18, 2015

13, 2017

Dear Fellow Shareholder:

On behalf of our Board of Directors and management, we cordially invite you to attend our Annual Meeting of Shareholders on Wednesday, April 29, 2015.26, 2017. The Meeting will be held at the Conrad New York Hotel, 102 North End Avenue,55 Water Street, New York, New York, 10282,10041, at 11:00 a.m. (EDT). If you are unable to attend the Annual Meeting in New York, please join us via live Webcastwebcast on the Company’s Websitewebsite at www.mhfi.com.www.spglobal.com.

The Notice of Meeting and Proxy Statement accompanying this letter describe the business we will consider at the Meeting. Your vote is very important. We urge you to vote to be certain your shares are represented at the Meeting even if you plan to attend. Most shareholders have a choice of voting over the Internet, by telephone or by using a traditional proxy card. Please refer to your proxy materials or the information forwarded by your bank, broker or other holder of record to see which methods are available to you.

We look forward to seeing you at the Meeting.

|

| |

Chairman of the Board | Douglas L. Peterson President and Chief Executive Officer |

| 55 Water Street

New York, NY 10041-0003 |

Notice of Annual Meeting of Shareholders

To Be Held Wednesday, April 29, 201526, 2017

The Annual Meeting of Shareholders of McGraw Hill Financial,S&P Global Inc. will be held onWednesday, April 29, 2015,26, 2017, at11:00 a.m. (EDT)at the Conrad New York Hotel, 102 North End Avenue, 55 Water Street, New York, New York, 10282.10041. At the Meeting, shareholders will be asked to:

elect 12 Directors;

Items of Business | Board’s Recommendation | |||||

1. Elect 12 Directors; |

| FOR each Director Nominee | ||||

2. Approve, on an advisory basis, the executive compensation program for the Company’s named executive officers, as described in this Proxy Statement; |  | FOR | ||||

3. Vote, on an advisory basis, on the frequency on which the Company conducts an advisory vote on the executive compensation program for the Company’s named executive officers; |  | 1 YEAR | ||||

4. Ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for 2017; and |  | FOR | ||||

5. Consider any other business, if properly raised. | ||||||

approveThis notice and proxy statement is being mailed or made available on the performance goals underInternet to shareholders on or about March 13, 2017. These materials describe the Company’s 2002 Stock Incentive Plan, as amendedmatters being voted on at the Annual Meeting and restated;

approve, on an advisory basis, the executive compensation program for the Company’s named executive officers, as described in this Proxy Statement;

ratify the appointmentcontain certain other information. In addition, these materials are accompanied by a copy of the Company’s independent Registered Public Accounting Firm2016 Annual Report, which includes financial statements as of and for 2015;

vote on one shareholder proposal, if properly presented at the Meeting; andfiscal year ended December 31, 2016.

consider any other business, if properly raised.

You may vote at the Meeting if you were a shareholderOnly shareholders of the Company at therecord as of close of business on March 9, 2015,6, 2017 may vote, in person or by proxy, at the Annual Meeting. If you plan to attend the Meeting in person and you are a shareholder of record, date foryou will need your admission ticket in order to enter the Meeting. YourIf you plan to attend the Meeting in person and you are a beneficial owner, you will need proof of beneficial ownership of the Company’s common stock as of that date in order to enter the Meeting. If you are unable to attend the Annual Meeting in New York, please join us via live webcast on the Company’s website at www.spglobal.com.

Whether or not you plan to attend the Meeting, your vote is very important.We urge you to participate in electing directors and deciding the other items on the agenda for the Annual Meeting. Please sign and returncast your votes by one of the enclosedfollowing methods:

The Internet |

Signing and Returning a Proxy Card |

Toll-Free Telephone |

If You Are a Shareholder of Record (as of March 6, 2017), in Person or by Proxy at the Annual Meeting |

If you accessed this proxy cardstatement through the Internet after receiving a Notice of Internet Availability of Proxy Materials, you may cast your vote over the Internet by following the instructions in that Notice.

If you received this proxy statement by mail, you may cast your vote by mail, by telephone or over the postage-paid envelope provided or, if you prefer, please followInternet by following the instructions on the enclosed proxy card for voting by telephone or via the Internet. You may access the Company’s Investor Relations Website at http://investor.mhfi.com for further Internet voting instructions.card.

By Order of the Board of Directors.

Scott L. BennettKatherine J. Brennan

Senior Vice President, AssociateDeputy General Counsel

Counsel and& Corporate Secretary

New York, New York

March 18, 201513, 2017

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDERS MEETING TO BE HELD ON APRIL 29, 2015.

THE COMPANY’S ANNUAL REPORT, LETTER TO SHAREHOLDERS, NOTICE OF MEETING, PROXY STATEMENT AND PROXY CARD ARE AVAILABLE AT www.mhfi.com/proxy/2015.

| 1 | ||||

| 7 | ||||

| 8 | ||||

| 10 | ||||

Process for Identifying and Evaluating Directors and Nominees | ||||

Specific Experience, Qualifications, Attributes and Skills of Directors | ||||

| 26 | |||

| 26 | ||||

| 27 | ||||

Processes and Procedures for Determining Executive Compensation | 27 | |||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 32 | |||

| ||||

| 32 | ||||

| 64 | ||||

| 65 | ||||

Independent Registered Public Accounting Firm’s Fees and Services | ||||

| ||||

| 2017 Proxy Statement | i |

| 96 | |||||

| ||||||

| 98 | ||||||

|

| A-1 | ||||

| ||||

| |  |

GENERAL INFORMATION |

McGraw Hill Financial,S&P Global Inc.

Proxy Statement

20152017 Annual Meeting of Shareholders

Why did I receive this Proxy Statement?

The Board of Directors of McGraw Hill Financial,S&P Global Inc. (the “Company,” “we” or “us”) is soliciting proxies for the 20152017 Annual Meeting of Shareholders (the “Annual Meeting” or “Meeting”) to be held on Wednesday, April 29, 2015,26, 2017, at the Conrad New York Hotel, 102 North End Avenue,55 Water Street, New York, New York 10282,10041, at 11:00 a.m. (EDT) and at any adjournment of the Meeting. When the Company asks for your proxy, we must provide you with a Proxy Statement that contains certain information specified by law. This Proxy Statement summarizes the information you need in order to vote at the Meeting.

The Company’s Annual Report, LetterWhy have I received a Notice Regarding Internet Availability of Proxy Materials instead of printed copies of these materials in the mail?

In accordance with rules promulgated by the Securities and Exchange Commission (“SEC”), we have elected to Shareholders,furnish our proxy materials to shareholders over the Internet. Most shareholders are receiving by mail a Notice of Internet Availability of Proxy Materials (“Notice”), which provides general information about the Annual Meeting, Proxy Statementthe address of the website on which our proxy statement and annual report are available for review, printing and downloading and instructions on how to submit proxy card are being mailedvotes. For those who wish to shareholders beginningreceive their materials in a different format (e.g., paper copy by mail or electronic copy bye-mail), the Notice contains instructions on or about March 18, 2015.how to do so. Shareholders who have previously consented to electronic delivery will receive ane-mail with a web address to view the proxy statement and annual report online, along with instructions on how to vote.

What will I vote on?

The following items:

election of 12 Directors;

| 1. | election of 12 Directors; |

approval of the performance goals under the Company’s 2002 Stock Incentive Plan, as amended and restated;

| 2. | approval, on an advisory basis, of the executive compensation program for the Company’s named executive officers, as described in this Proxy Statement; |

approval, on an advisory basis, of the executive compensation program for the Company’s named executive officers, as described in this Proxy Statement;

| 3. | vote, on an advisory basis, on the frequency on which the Company conducts an advisory vote on the executive compensation program for the Company’s named executive officers; |

ratification of the appointment of the Company’s independent Registered Public Accounting Firm for 2015;

| 4. | ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for 2017; and |

one shareholder proposal, provided the proposal is properly presented at the Meeting; and

| 5. | other matters that may properly be brought before the Meeting. |

other matters that may properly be brought before the Meeting.

Will there be any other items of business on the agenda?

We do not expect any other items of business at the Annual Meeting. Nonetheless, if there is an unforeseen need, your proxy will give discretionary authority to the persons named on the proxy to vote on any other matters that may be properly brought before the Meeting. These persons will use their best judgment in voting your proxy.

Who can vote?

Shareholders as of the close of business on the record date, which is March 9, 2015,6, 2017, may vote at the Annual Meeting.

How many votes do I have?

You have one vote at the Meeting for each share of common stock you held on the record date.

| 2017 Proxy Statement | 1 |

GENERAL INFORMATION (continued) |

What does it mean to be a “shareholder of record?”record”?

If, as of the close of business on the record date, your shares were registered directly in your name with the Company’sour transfer agent, Computershare, then you are a “shareholdershareholder of record. As a shareholder of record,” also known you may vote in person at the Meeting or by proxy. The Company is incorporated in New York and, in accordance with New York law, a list of the Company’s common shareholders of record as a “registered shareholder.”of the record date will be available for inspection at the Annual Meeting upon request.

What does it mean to beneficially own shares in “street name?”name”?

If, as of the close of business on the record date, your shares were not held directly in your name but rather were held in an account at a broker,brokerage firm, bank or other holder of record (collectively referred to as “broker”),similar intermediary organization, then you are the beneficial ownerholder of shares held in “street name” and these proxy materials are being forwardedname.” The intermediary is considered to you by that broker. The broker holding your account is consideredbe the shareholder of record for purposes of voting at the Annual Meeting.

|

How do I vote my shares of Company common stock?

If you are ashareholder of record, you can vote in the following ways:

| • | By |

| • | By Telephone. |

| • | By Mail. |

| • | In Person. |

If you are abeneficial owner, you can vote in the following ways:

As the beneficial owner, you have the right to direct your broker on how to vote the shares in your account. Your broker should give you instructions for voting your shares by Internet, telephone or mail. As a beneficial owner, you are invited to attend the Annual Meeting, but you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker giving you the legal right to vote the shares at the Annual Meeting.

How will my shares be voted if I do not give specific voting instructions when I deliver my proxy?

Shareholders of Record.Record

If you are a shareholder of record and you return a signed proxy card without indicating your vote for some or all of the matters, your shares will be voted as follows for any matter you did not vote on:

| • |

|

| • |

|

|

| • | “1 YEAR”for the frequency on which, on an advisory basis, the Company conducts an advisory vote on the executive compensation program for the Company’s named executive officers with a frequency of every one year; and |

| • | “FOR”the ratification of the |

| 2017 Proxy Statement |  |

|

Beneficial Owners.Owners

As noted above, as the beneficial owner of shares held in street name, your broker is required to vote your shares in accordance with your instructions. If you do not give instructions, one of two things can happen depending on whether the proposal is considered “routine” or “non-routine”“non-routine” under the rules of the New York Stock Exchange (the “NYSE”):

If the proposal is considered “routine” under the rules of the NYSE, the broker may vote your shares in its discretion.

If the proposal is considered “non-routine”“non-routine” under the rules of the NYSE, the broker may not vote your shares without your instructions. When a broker refrains from voting your shares because the broker has not received your instructions, it is called a “brokernon-vote.”

Item 4 in this Proxy Statement (ratification of the appointmentselection of the Company’sErnst & Young LLP as our independent Registered Public Accounting Firmregistered public accounting firm for 2015)2017) will be considered routine under the rules of the NYSE and the broker may vote your shares for this Item in its discretion. The broker is not entitled to vote your shares on the other Items unless the broker has received instructions from you.

|

What should I do if I want to attend the Annual Meeting?

All shareholdersShareholders (of record or beneficial) and employees of the Companytheir proxy holders may attend the Meeting.

If you are a shareholder of record and receive your proxy materials by mail, you will find an admission ticket attached as part of the proxy card or Notice sent to you. If you plan to attend the Annual Meeting, please bring your admission ticket with you to the Meeting. If you are a shareholder of record and receive your materials electronically, and vote via the Internet, please print out the admission ticket you will find online and bring it with you.

If your shares are held in street name (i.e., you are a beneficial owner), you must bring to the Meeting an account statement or letter from the record holder (i.e., the broker, bank, trustee or other intermediary organization that holds your shares) indicating that you were the beneficial owner of the shares on March 6, 2017.

When you arrive at the Annual Meeting, you may be asked to present photo identification, such as a driver’s license, to be admitted. McGraw Hill Financial,S&P Global Inc. employees wishing to attend the Annual Meeting can present their current employee identification card to be admitted.

Shareholders of Record. If you are a shareholder of record, you will find an admission ticket attached as part of the proxy card sent to you. If you plan to attend the Annual Meeting, please bring this portion of the proxy card with you to the Meeting. If you opted to receive your proxy materials electronically, please print out the admission ticket you will find online and bring it with you.

Beneficial Owners. If you are a beneficial owner, please bring proof of ownership to be admitted to the Annual Meeting. A recent brokerage statement or letter from your broker is an example of proof of ownership.

For safety and security reasons, no cameras, large bags, briefcases, packages, recording equipment or other electronic devices will be permitted in the Annual Meeting.

Whether you hold shares as a shareholder of record or are a beneficial owner, we urge you to vote in advance even ifby Internet, telephone or mail so that your vote will be counted in the event you planlater decide not to attend the Annual Meeting so we will know as soon as possible that enough votes will be present for us to hold the Annual Meeting.

How do I vote my shares in the Company’s Dividend Reinvestment Plan?

If you participate in the Company’s Dividend Reinvestment Plan, any proxy you give will also govern the voting of all shares you hold in this Plan, unless you give us other instructions.Plan.

How do I vote my shares in the Company’s Employee Stock Purchase Plan?

If you participate in the Company’s Employee Stock Purchase Plan, any proxy you give will also govern the voting of any shares you hold in

this Plan. Any Plan shares for which we do not receive instructions from the employee will not be voted. Plan shares cannot be voted in person at the Meeting.

How do I vote my shares in the Company’s 401(k) Savings and Profit Sharing Plans?

If you received this Proxy Statement because you are an employee of the Company who participates in one of the Company’s 401(k) Savings and Profit Sharing Plans and you have shares of common stock of the Company

| 2017 Proxy Statement | 3 |

GENERAL INFORMATION (continued) |

allocated to your account under one of these Plans, you may vote your shares held in these Plans as of March 9, 20156, 2017 by mail, by telephone or via the Internet. Instructions are provided on the proxy card you received from Computershare. Computershare must receive your instructions by 2:00 p.m. (EDT) on April27, 2015April 24, 2017 in order to communicate your instructions to the Plans’ Trustee, who will vote your shares. Any Plan shares for which we do not receive instructions from the employee will be voted by the Trustee in the same proportion as the shares for which we have received instructions. Plan shares cannot be voted in person at the Meeting.

Can I revoke or change my vote?

Yes. If you are a shareholder of record, you have the right to revoke your proxy at any time before the Annual Meeting by sending a signed notice to the Corporate Secretary, c/o Office of the General Counsel, McGraw Hill Financial,S&P Global Inc., 55 Water Street, New York, New York 10041-0003.10041-0003 or by sending an e-mail to the Corporate Secretary at corporate.secretary@spglobal.com. If you want to change your vote before the Meeting, you must deliver a later dated proxy by telephone, via the Internet or in writing. You may also change your proxy by voting in person at the Meeting.

If you are a beneficial owner, please refer to the information forwarded by your broker for procedures on revoking or changing your proxy.

What are the requirements to conduct business at the Annual Meeting?

In order to conduct business at the Annual Meeting, we must have a quorum. This means at least a majority of the outstanding shares entitled to vote must be present in person or represented by proxy at the Annual Meeting. You are

|

part of the quorum if you have voted by proxy. As of the record date, 274,084,154258,562,581 shares of Company common stock were outstanding and eligible to vote.

Are abstentions and brokernon-votes part of the quorum?

Yes. Abstentions and brokernon-votes count as “shares present” at the Annual Meeting for purposes of determining a quorum.

What are the costs of soliciting these proxies and who will pay them?

The Company will pay all costs of soliciting these proxies. In addition, some of our officers and employees may solicit proxies by telephone or in person. We will reimburse brokers for the expenses they incur in forwarding the proxy materials to you. The Company has retained Georgeson Inc.LLC to assist us with the solicitation of proxies for a fee not to exceed $18,000, plus reimbursement forout-of-pocket expenses.

How many votes are required for the approval of each Item?

Item One – A nominee will be elected as a Director if he or she receives a majority of the votes cast at the Annual Meeting. A majority of votes cast means that the number of shares voted “for” a Director’s election exceeds the number of votes cast “against” that Director’s election. If an incumbent Director who has been nominated forre-election fails to receive a majority of the votes cast in an uncontested election, New York law provides that the Director continues to serve as a Director in a hold-over capacity. The Company’sBy-Laws provide that, in such circumstances, the Director is required to promptly tender his or her resignation to the Board of Directors. The Board’s Nominating and Corporate Governance Committee is then required to make a recommendation to the Board as to whether to accept or reject the tendered resignation. The Board will act on the tendered resignation and will publicly disclose its decision and rationale within 90 days following certification of the election results. If a Director’s resignation is accepted by the Board, the Board may fill the vacancy or decrease the size of the Board. Abstentions and brokernon-votes, if any, will not be counted either for or against the election of a Director nominee.

|

Item Two – The affirmative vote of the holders of a majority of the votes cast is required to approve, the performance goals under the Company’s 2002 Stock Incentive Plan, as amended and restated. Abstentions and broker non-votes, if any, will not be counted either for or against this proposal.

Item Three – The affirmative vote of the holders of a majority of the votes cast is required to approve, on an advisorynon-binding basis, the executive compensation program for the Company’s named executive officers, as described in this Proxy Statement. Abstentions and brokernon-votes, if any, will not be counted either for or against this proposal.

| 4 | 2017 Proxy Statement |  |

GENERAL INFORMATION (continued) |

Item Three – The advisory vote on the frequency of the advisory vote on the executive compensation program for the Company’s named executive officers is anon-binding vote and the Company will consider the results of the vote in determining whether to hold the advisory vote on the executive compensation program for the Company’s named executive officers every one, two or three years. Abstentions and brokernon-votes, if any, will not be counted in favor of any frequency in the vote.

Item Four – The affirmative vote of the holders of a majority of the votes cast is required to ratify the appointmentselection of the Company’sErnst & Young LLP as our independent Registered Public Accounting Firmregistered public accounting firm for 2015.2017. Abstentions and brokernon-votes, if any, will not be counted either for or against this proposal.

Item Five– The affirmative vote of the holders of a majority of the votes cast is required to approve the shareholder proposal.Abstentions and broker non-votes, if any, will not be counted either for or against this proposal.

Who will count the vote?

Votes at the Annual Meeting will be counted by twoone or more independent inspectors of election appointed by the Board.

How do I submit a shareholder proposal for the 20162018 Annual Meeting?

The Company’s 20162018 Annual Meeting is currently scheduled for April 27, 2016.25, 2018. There are twothree different deadlines for submitting shareholder proposals. First, if a shareholder wishes to have a proposal considered for inclusion in next year’s Proxy Statement, he or she must submit the proposal in writing so that we receive it by 5:00 p.m. (EST) on November 19, 2015.13, 2017. Proposals should be addressed to the Corporate Secretary, c/o Office of the General Counsel, McGraw Hill Financial,S&P Global Inc., 55 Water Street, New York,

|

New York 10041-0003.10041-0003 or by sending an e-mail to the Corporate Secretary at corporate.secretary@spglobal.com. If you submit a proposal, it must comply with applicable laws, including Rule14a-8 of the Securities Exchange Act of 1934.

On January 27, 2016, we amended ourBy-Laws to include a proxy access provision. The Company’sBy-Laws now permit a shareholder, or group of up to 20 shareholders, owning continuously for at least three years shares of common stock representing an aggregate of at least 3% of our outstanding shares, to nominate and include in next year’s Proxy Statement director nominees constituting up to two individuals or 20% of the Company’s Board of Directors, whichever is greater, provided that the shareholder(s) and nominee(s) satisfy the requirements in the Company’sBy-Laws. Notice of proxy access director nominees must be received no earlier than October 14, 2017, and no later than November 13, 2017.

In addition, the Company’sBy-Laws provide that any shareholder wishing to nominate a candidate for Director or to propose any other business at the Annual Meeting, but not intending to have such nomination or business included in next year’s Proxy Statement, must give the Company written notice no earlier than December 30, 201527, 2017 and no later thanJanuary 29, 2016.26, 2018. This notice must comply with applicable laws and the Company’sBy-Laws. Copies of theBy-Laws are available to shareholders free of charge on request to the Corporate Secretary, c/o Office of the General Counsel, McGraw Hill Financial,S&P Global Inc., 55 Water Street, New York, New York 10041-0003.10041-0003 or by sending an e-mail to the Corporate Secretary at corporate.secretary@spglobal.com. You may also download theBy-Laws from the Corporate Governance section of the Company’s Investor Relations Websitewebsite at http://investor.mhfi.com.investor.spglobal.com.

May I view future proxy materials online instead of receiving them by mail?

Yes. Shareholders may provide their consent to electronic delivery of Proxy Statements and Annual Reports instead of receiving them by postal mail. If you elect this feature, you will receive ane-mail notice which will include the Webweb address for viewing the materials online. Thee-mail notice will also include instructions so you can vote your proxy online or by telephone. If you have more than one account, you may receive separatee-mails for each account. Costs normally associated with electronic delivery, such as usage and telephone charges, as well as any costs incurred in printing documents, will be your responsibility.

During the 20152017 proxy voting period, the Internet voting systems will automatically provide shareholders the option to consent to electronic delivery of future years’ materials.

| 2017 Proxy Statement | 5 |

GENERAL INFORMATION (continued) |

During the year, shareholders may provide their consent to electronic delivery by going to the appropriate website:

Shareholders of record go to www.computershare.com/investor

Beneficial owners go to https://enroll.icsdelivery.com/mhfispgi

Owners of shares through one of the Company’s 401(k) Savings and Profit Sharing Plans go to www.mhfibenefits.comwww.spglobalbenefits.com

What are the benefits of electronic delivery?

Electronic delivery benefits the environment and saves the Company money by reducing printing and mailing costs. It will also make it convenient for you to view your proxy materials and vote your shares online. If you have shares in more than one account, it is also an easy way to eliminate receiving duplicate copies of proxy materials.

What are the costs of electronic delivery?

The Company charges nothing for electronic delivery. You may, of course, incur expenses associated with Internet access such as telephone charges or charges from your Internet service provider.

How do Iopt-out of electronic delivery?

At any time, shareholders may revoke their consent to electronic delivery and resume postal mail delivery of the Proxy Statement and Annual Report by going to the appropriate website:

Shareholders of record go to www.computershare.com/investor

Beneficial owners go to https://enroll.icsdelivery.com/mhfispgi

Owners of shares through one of the Company’s 401(k) Savings and Profit Sharing Plans go to www.mhfibenefits.comwww.spglobalbenefits.com

Will I receive a print copy of the Company’s Annual Report?

Unless you previously elected to view our Annual Report via the Internet, we mailed our 2014 Annual Report to shareholders beginning on or about March 18, 2015.

What is “householding?”“householding”?

We have adopted “householding,” a procedure under which beneficial owners who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of our Annual Report and Proxy Statement unless one or more of these shareholders notifies us that they wish to

|

continue receiving individual copies. This procedure reduces duplicate mailings and thus reduces our printing costs and postage fees. Shareholders who participate in householding will continue to receive separate proxy cards. Householding does not affect dividend check mailings.

How do I request a separate paper ore-mail copy of the Proxy Statement or Annual Report at no charge?

If you wish to receive a separate paper ore-mail copy of the 20142016 Annual Report or this Proxy Statement at no charge, please call us toll-free at(866) 436-8502, or send ane-mail to investor.relations@mhfi.com,investor.relations@spglobal.com, or write to: Investor Relations, McGraw Hill Financial,S&P Global Inc., 1221 Avenue of the Americas,55 Water Street, New York, New York 10020-1095.10041-0003. We will promptly deliver to you the documents you requested. Please make your request for documents on or before April 15, 201513, 2017 to facilitate timely delivery of the documents to you prior to the Annual Meeting.

Where can I find the voting results?

We expect to announce preliminary voting results at the Annual Meeting. We will also publish voting results in aForm 8-K which we will file with the SEC on or before May 5, 2015.2, 2017. To view thisForm 8-K online, log on to the Company’s Investor Relations Websitewebsite at http://investor.mhfi.com,investor.spglobal.com, and click on the SEC Filings link located in the Digital Investor Kit.link.

Can shareholders and other interested parties communicate directly with our Board? If so, how?

Yes. You may communicate directly with one or more members of the Board by writing to the Corporate Secretary, c/o Office of the General Counsel, McGraw Hill Financial,S&P Global Inc., 55 Water Street, New York, New York 10041-0003, or by sending ane-mail to the Corporate Secretary at corporate.secretary@mhfi.com.corporate.secretary@spglobal.com. The Corporate Secretary will then forward all questions or comments directly to our Board or a specific Director, as the case may be.

| 6 | |   |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

The Company’s business and affairs are overseen by our Board pursuant to the New York Business Corporation Law and our Restated and Amended Certificate of Incorporation andBy-Laws. We currently have 1314 Directors, all12 of whom with the exception of Mr. Harold McGraw III, are being nominated at this Annual Meeting for a one-year term terms which will expire at the Annual Meeting in 2016.2018. (See Item 1 on page 84.96.)

On February 25, 2015, Mr. McGraw informed the Board of his decision not to stand for re-election as a Director at this Annual Meeting. Mr. McGraw has been Non-Executive Chairman of the Board since his retirement from the Company on November 1, 2013. Prior to his retirement, he had been Chairman of the Board since 2000, President and Chief Executive Officer of the Company since 1998 and a Director of the Company for 27 years. In recognition of Mr. McGraw’s many significant contributions to the Company, the Board will confer upon him the honorary title of Chairman Emeritus when he retires as a Director on April 29, 2015.

The Company’s normal retirement age for Directors is 72. Based on the recommendation of the Nominating and Corporate Governance Committee, this policy has beenwas waived last year with respect to Sir Winfried Bischoff, who turned 73 this year. Accordingly,Bischoff. Sir Winfried Bischoff will retire from the Board at the 2017 Annual Meeting and will not stand forre-election at the Meeting. Ms. Ochoa-Brillembourg will also retire from the Board at the 2017 Annual Meeting and will not stand for re-election at the meeting.

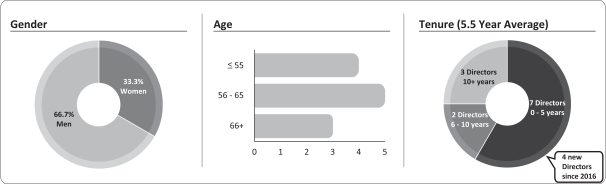

Governance Highlights

Snapshot: Board of Directors

| 2017 Proxy Statement | 7 |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

Enhanced Corporate Governance Environment

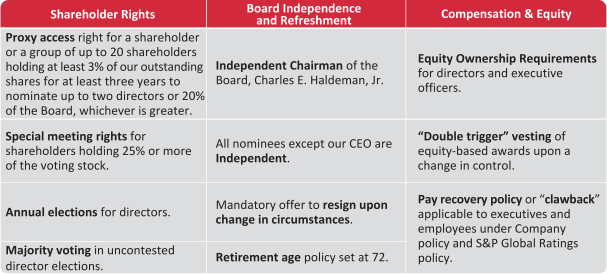

The Board of Directors has taken a series of actions designed to enhance the Company’s corporate governance environment. The Company’s current corporate governance structure reflects an ongoing commitment to strong and effective governance practices and a willingness to be responsive and accountable to shareholders. We regularly assess and refine our corporate governance policies and procedures to take into account evolving best practices and the interest of our shareholders. Our corporate governance structure includes:

Board Structure / Declassification of Board

| ü | Board Independence. All of the Company’s director nominees are independent, with the exception of our CEO, who is the only member of management serving on the Board. |

| ü | Independent Chairman. The Company currently maintains separate roles of chief executive officer and chairman of the Board. An independent director acts as chairman of the Board. |

| ü | Offer to Resign upon Change in Circumstances. Pursuant to our Corporate Governance Guidelines, any director undergoing a significant change in personal or professional circumstances must offer to resign from the Board. |

Board Refreshment and Diversity

| ü | Board Membership. Since 2016, we have added four new independent directors who have brought valuable and varied experience in distinct and critical areas, each providing a fresh perspective to our Board. Their appointments underscore the Company’s commitment to inviting diverse backgrounds, perspectives, skills and experience into the Board room to guide the growth and performance of the Company. |

| ü | Board Skills. Throughout 2016, the Nominating and Corporate Governance Committee undertook a comprehensive review of the skills and qualifications of the Board, and the critical skills necessary to guide the Company forward. In 2016 and 2017, we added important skills to our Board in the areas of technology, international operations and commodity markets. |

| ü | Diversity. We believe that diversity is an important attribute of a well-functioning Board. While diversity can be measured in many ways, we note that our 12 Director nominees include 4 women and 2 African-Americans. |

| ü | Board Tenure. Since 2011, we have reduced the average tenure of our Board from 11.3 years to 5.5 years. |

Election of Directors / Right of Shareholders to Call Special Meetings

| ü | Annual Election of Directors. The Company’s charter provides for the annual election of directors. |

| ü | Majority Voting in Director Elections. The Company’sBy-Laws provide that in uncontested elections, director candidates must be elected by a majority of the votes cast. In uncontested director elections, a director who does not receive a majority of the votes cast must offer to submit his or her resignation for consideration. |

| ü | Shareholder Right to Call Special Meetings. The Company’sBy-laws allow shareholders of record of twenty-five percent (25%) or more of the voting power of the Company’s outstanding common stock to call a special meeting. |

Shareholder Recommendations / Proxy Access

| ü | Shareholder Recommendations. Shareholders can submit recommendations of director candidates for consideration by the Nominating and Corporate Governance Committee. |

| ü | Proxy Access. A shareholder, or group of up to 20 shareholders, owning continuously for at least three years shares of common stock representing an aggregate of at least 3% of our outstanding shares, may nominate and include in the Company’s Proxy Statement director nominees constituting up to two individuals or 20% of the Company’s Board of Directors, whichever is greater. |

| 8 | 2017 Proxy Statement |  |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

Management Succession Planning

| ü | CEO Succession Planning. The Board believes that one of its primary responsibilities is to oversee the development and retention of executive talent and to ensure that an appropriate succession plan is in place for our Chief Executive Officer and other members of management. Additional information can be found beginning on page 12 of this Proxy Statement. |

| ü | Board Talent Agenda. In 2017, the full Board added specific talent management topics as standing agenda items at four out of six of its scheduled in-person meetings. |

Compensation Practices

| ü | “Double-Trigger” Condition for Vesting of Equity-Based Awards upon a Change in Control. Awards granted under the Company’s 2002 Stock Incentive Plan after December 31, 2014 are subject to “double-trigger” treatment in the case of achange-in-control. Additional information can be found in our Compensation Discussion and Analysis section, beginning on page 32 of this Proxy Statement. |

| ü | Pay Recovery Policy. The Company may recover (or “claw back”) cash incentive and long-term incentive award payments received by covered active and former employees and executives under various circumstances, including misconduct and financial restatements, under the applicable Company policy and S&P Global Ratings policy. Additional information can be found beginning on page 63 of this Proxy Statement. |

Equity Ownership Requirements

| ü | Senior Executive Equity Ownership Requirements. The Company maintains equity ownership standards requiring senior management to hold shares or stock units of our common stock with a value equal to a multiple of base salary. Until the guidelines for ownership levels are attained, senior executives must retain 100% of the net shares received (after payment of taxes and any exercise price) upon the exercise of stock options, the payment of PSU and RSU awards and the vesting of any restricted stock awards. Additional information can be found on page 62 of this Proxy Statement. |

| ü | Director Equity Ownership Requirements. Each Director is required to hold 400 shares of the Company’s common stock within 90 days of his or her election to the Board and to hold such shares through his or her tenure as a Director. Additionally, under the Company’sNon-Employee Director Stock Ownership Guidelines, eachnon-employee Director is required to own or acquire, within five years of election to the Company’s Board of Directors, shares of common stock of the Company having a market value of at least five times the annual cash retainer for serving as a Director of the Company. Additional information can be found on page 89 of this Proxy Statement. |

| 2017 Proxy Statement | 9 |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

Corporate Governance Materials

The following corporate governance materials are available and can be viewed and downloaded from the Corporate Governance section of the 12Company’s Investor Relations website at http://investor.spglobal.com:

the Company’s Amended and Restated Certificate of Incorporation;

the Company’sBy-Laws;

the Company’s Corporate Governance Guidelines;

Board Committee Charters for the Company’s Audit, Compensation and Leadership Development, Executive, Financial Policy and Nominating and Corporate Governance Committees;

the Code of Business Ethics applicable to all Company employees;

the Code of Ethics applicable to the Company’s Chief Executive Officer and Senior Financial Officers;

the Code of Business Conduct and Ethics for Directors who has been nominated byapplicable to all the Board for election to a one-year term of office that will expire at Company’s Directors; and

the next Annual Meeting or until his successor is electedAudit Committee’s Policy concerning Employee Complaint Procedures Regarding Accounting and otherwise qualifies for service.Auditing Matters.

The Board has determined that all of the Company’s current Directors, with the exception of Messrs. Harold McGraw III (the Company’s Non-Executive Chairman),Mr. Douglas L. Peterson (the Company’s President and Chief Executive Officer) and Robert P. McGraw (the brother of Harold McGraw III), have met the independence requirements of the New York Stock Exchange based upon the application of objective categorical standards adopted by the Board. In addition,

Ms. Lorimer was considered to be independent as well during the portion of the 2014 year during which she served on our Board. To be considered independent, a Director must have no material relationship (other than as a Director) with the Company, or any of its subsidiaries, either directly or as a partner, shareholder or officer of an organization that has a material relationship with the Company or any of its subsidiaries. In making independence determinations, the Board broadly considers all relevant facts and circumstances.

In accordance withaddition, members of the Company’s Corporate Governance Guidelines,Audit Committee must also satisfy a Director willseparate SEC and NYSE independence requirement, which provides that they may not be an independent Directoraffiliates and may not accept directly or indirectly any consulting, advisory or other compensatory fee from the Company or any of its subsidiaries, other than their directors’ compensation. The Board evaluated each member of the Company if:

|

For purposesCompensation Committee under the additional NYSE compensation committee member standards and also determined that these members qualify as“non-employee directors” (as defined under Rule16b-3 under the Securities Exchange Act of sub-paragraphs (i) through (v) above, an “immediate family member” includes a person’s spouse, parents, children, siblings, mothers1934) and fathers-in-law, sons and daughters-in-law, brothers and sisters-in-law and anyone (other than domestic employees) who shares such person’s home. Individuals who are no longer immediate family members as a result“outside directors” (as defined in Section 162(m) of legal separation or divorce, or those who have died or become incapacitated are not taken into consideration with respect to the determination of a Director’s independence.Internal Revenue Code).

Additional Information Regarding Director Independence

In making its independence determinations with respect to our Directors, the Board considered the following transactions that the Company engages in from time to time with organizations in which our independent Directors serve as executive officers or otherwise have a material interest:

|

|

| • | Cisco Systems, Inc. Ms. Rebecca Jacoby is the |

| • |

|

| • | MetLife, Inc. Ms. Maria R. Morris is the Executive Vice President leading MetLife, Inc.’s Global Employee Benefits business. The Company and |

| 10 | 2017 Proxy Statement |  |

|

services from time to time to |

| • | Snam S.p.A. Mr. Marco Alverà is the Chief Executive Officer of Snam S.p.A. The Company and its divisions provide the following types of products and services from time to time to Snam S.p.A.: credit ratings services. |

All of these transactions are entered into in the ordinary course of business and on terms that are substantially equivalent to those prevailing at the time for comparable transactions with other similarly situated customers or vendors of the Company. None of the transactions described above exceeds 1% of the Company’s consolidated gross revenue or that of such other company.

In making its independence determinations with respect to our Directors, the Board reviews the materiality of these transactions not only from the standpoint of the applicable Director but also from the standpoint of the organizations in which they serve. Based on this review, the Board has concluded that these transactions do not, and in

|

the case of Ms. Lorimer, did not interfere with the ability of each such Director to exercise independent judgment in carrying out his or her Board responsibilities.

It is the Company’s policy that, subject to illness or an unavoidable schedule conflict, all Directors will attend and be introduced at the Annual Meeting. All of our Directors attended the 20142016 Annual Meeting.

Leadership Structure of the Board of Directors

The Company’s business and affairs are overseen by its Board of Directors which currently has 13 members. There is one management representative on the Board and, of the 12 remaining Directors, 10 are independent. As mentioned above, Mr. Harold McGraw III informed the Board on February 25, 2015 of his decision not to stand for re-election to the Board at this Annual Meeting.

The Board has standing Nominating and Corporate Governance, Audit and Compensation and Leadership Development Committees composed solely of outside independent Directors. The Chair of each Committee reports to the full Board as appropriate from time to time. In addition to these three standing Committees, the Board has an Executive Committee and a Financial Policy Committee.

The Company’s Corporate Governance Guidelines provide that the Board shall select annually the Chairman of the Board based upon such criteria as the Company’s independent Nominating and Corporate Governance Committee recommends and what the Directors believe to be in the best interests of the Company at a given point in time. This process shall include consideration of whether the roles of Chairman and Chief Executive Officer should be combined or separated based upon the Company’s needs and the strengths and talents of its executives at any given time.

Based on these criteriaAlthough the Board regularly considers and is open to different structures as part of its ongoing reviewcircumstances may warrant, the Board believes that it is in the best interests of the Board leadership structureCompany and suc-

cession planning process, the Board determinedits shareholders at this time that the positions of Chairman and Chief Executive Officer and Chairman should be held by separate individuals. Accordingly, effective April 30, 2014, the Board appointed Mr. Douglas L. Peterson President and Chief Executive Officer and Mr. Harold McGraw III Non-Executive Chairman of the Board. In this role, Mr. McGraw has provided leadership to the Board by, among other things, chairing meetings of the Board and working with the Chief Executive Officer, the Presiding Director (discussed below) and the Corporate Secretary to: set Board calendars; determine agendas for Board meetings; ensure proper flow of information to Board members; facilitate effective operation of the Board and its Committees; help promote Board succession planning and the orientation of new Directors; and assist in consideration and Board adoption of the Company’s long-term and annual operating plans.

The Company’s Corporate Governance Guidelines further provide that, in the event that the Chairman of the Board is not an independent Director, the Board shall designate an independent Director to serve as Presiding Director. The position of Presiding Director is intended to provide a check and balance on the role and responsibilities of the Chief Executive Officer. The selection of the Presiding Director shall be made at a meeting (or that portion of a meeting) at which only independent Directors are present. The Board determined to continue to designate a Presiding Director for as long as Mr. McGraw served as Non-Executive Chairman in view of the fact that Mr. McGraw does not meet the New York Stock Exchange standards of independence due to his prior service as our President and Chief Executive Officer. Accordingly, on April 30, 2014, the Board appointed Mr. Edward B. Rust, Jr., the Chairman of the Nominating and Corporate Governance Committee, the Presiding Director of the Board for the period April 30, 2014 through April 29, 2015. As contemplated by our Corporate Governance Guidelines, the Presiding Director has the following responsibilities:

(i) be readily available to be consulted by any of the senior executives of the Company as to any concerns they may have about the Company; (ii) be readily available to all Directors to communicate

|

their issues and concerns to the Chairman or the Chief Executive Officer; (iii) be readily available to the Chief Executive Officer to offer counsel; (iv) preside at all meetings of the Board at which the Chairman is not present, including all meetings of non-management Directors and all executive sessions of the independent Directors; (v) authority to call meetings of the independent Directors including in the event of a crisis and/or the incapacitation of the Chief Executive Officer; (vi) communicate Directors’ feedback to the Chief Executive Officer from the meetings of the non-management Directors and from informal conversations with Directors; (vii) communicate Directors’ feedback to the Chairman and the Chief Executive Officer from the executive sessions of the independent Directors; (viii) review the proposed agenda for each upcoming Board meeting and the annual Board calendar; (ix) review and approve meeting schedules to assure there is sufficient time for discussion of all agenda items; (x) consult with the other Directors and advise the Chief Executive Officer about the quality and timeliness of the materials distributed to the Board; (xi) review and approve the materials and information sent to the Board; (xii) interview, along with the Chief Executive Officer, the Chairman and the Nominating and Corporate Governance Committee, candidates for the Board; and (xiii) assist the Nominating and Corporate Governance Committee with broad issues of corporate governance.

As a result of Mr. McGraw’s decision not to stand for re-election as a Director at this Annual Meeting, the Board will propose that Mr. Charles E. Haldeman, Jr. serve as Chairman of the Board following the 2015 Annual Meeting. Mr. Haldeman has been an independent Director of the Company since 2012. Further, consistent with the Company’s Corporate Governance Guidelines, the Board has determined that it is no longer necessary to continue to designate a Presiding Director following Mr. Haldeman’s appointment as an independent Chairman of the Board.

The Board believes that this leadership structure will continue to assure the appropriate level of management oversight and independence for the Company.

Mr. Charles E. Haldeman is currently the Board’s independent chairman. The only member of management who serves on the Board is Mr. Douglas L. Peterson, the Company’s President and Chief Executive Officer. The position of chairman of the Board has been held by an independent director since 2015. The Board will continue to periodically evaluate whether the structure is in the best interests of shareholders.

Role of Board of Directors in Risk Oversight

The Board has oversight responsibility for the Company’s risk management framework, which is designed to identify, measure, assess, prioritize, mitigate, monitor and communicate risks across the Company’s operations, and foster a corporate culture of Directors administers itsintegrity and risk oversight role through its Committee structureawareness. Consistent with this approach, one of the Board’s primary responsibilities is interacting with senior management with respect to risk assessment and risk mitigation of the Committees’ regular reports to the Board at each Board meeting.Company’s top risks. The Board’s Audit Committee meets frequently during the yearreviews and discusses with management the Company’s Enterprise Risk Management process, including its risk governance framework and risk management practices. In addition, the Board has tasked designated Committees of the Board with certain categories of risk management, and the Committees report to the Board regularly on these matters.

Audit Committee

The Audit Committee considers the Company’s Enterprise Risk Management and also risks related to financial reporting and internal control risks. The Committee discusses with management, the Company’s chief audit

| 2017 Proxy Statement | 11 |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

executive, and the Company’s independent external auditor: (a) current business trends affecting the Company; (b) the major risk exposures facing the Company; (c) the steps management has taken to monitor and controlmitigate such risk factors; and (d) the adequacy of internal controls that could significantly affect the Company’s financial statements. The Chair of the Audit Committee provides the Board with a report concerning its risk oversight activities at each Board meeting.

In 2014, theCompensation and Leadership Development Committee

The Compensation and Leadership Development Committee establishedconsiders risks related to compensation policies and practices and incentive-related risks. The Committee establishes performance metrics that focused on net income, revenuereward our executives for creating shareholder value, and earnings per share growth, and establishedestablishes goals and payment schedules for each metric that wereare designed to provide a balance to motivate the achievement of the established goals without the need for inappropriate or excessive risk taking by providing a range of payment opportunities for achievement both below and above the target goals established for the short and long-term incentives.taking. In addition, the Committee reviews and assesses plan design, performance metrics, and goals for the annual incentive plans within the Company’s business unitsdivisions to ensure that thetheir designs of those annual incentive plansare appropriately aligned with business and regulatory considerations and do not encourage inappropriate or excessive risk taking.

In 2014, the Compensation and Leadership Development Committee adopted amendments to the Company’s Pay Recovery Policy (the “Policy”). The amended Policy is more robust, expanding the compensation that may be clawed back to most variable compensation and

|

covering a greater number of executives. The amended Policy applies to incentive plan participants from Managing Director/Vice President levels across the Company and provides a claw-back opportunity for financial restatements and other circumstances where an executive’s behavior has resulted in damaging the Company’s reputation. The Committee approved the amended Policy effective January 1, 2015.

In 2015,2017, management updated its prior review of the Company’s incentive compensation plans as well as the Company’s other compensation policies and practices. The findingspractices regarding whether the Company’s compensation plans, programs and conclusions of the updated review arepolicies encourage excessive risk taking and determined that the Company’s compensation policiesplans, programs and practicespolicies do not encourage excessive risk taking and are not reasonably likely to have a material adverse effect on the Company. Management then reviewed itsthese findings with the Committee.Committee who concurred. Pay Governance LLC, the Committee’s independent compensation advisor,consultant, also advised the Committee on this matter and concurred in these findings and conclusions.

Financial Policy Committee

The Financial Policy Committee oversees financial risks, with particular emphasis on the Company’s financial

position, its capital structure, its dividend policy, its share repurchase policy and its capital expenditure program.

Succession Planning

The Board believes that one of its primary responsibilities is to oversee the development and retention of executive talent and to ensure that an appropriate succession plan is in place for our Chief Executive Officer and other members of management.

The Nominating and Corporate Governance Committee reviews with the Chief Executive Officer, on an annual basis, the Chief Executive Officer’s recommendations concerning an emergency succession plan for the Chief Executive Officer in the event of extraordinary circumstances such as the death or disability of the Chief Executive Officer, as well as succession planning in general for the Chief Executive Officer.

The Compensation and Leadership Development Committee oversees the process for succession planning for senior management positions from a talent management perspective. The Compensation and Leadership Development Committee holds a formal succession planning and talent review session annually which includes succession planning for all senior management positions, and the Chief Executive Officer presents an overview to the full Board. These talent review and succession planning discussions take into account desired leadership skills, key capabilities and experience in light of our current and evolving business and strategic direction. Our Directors also have exposure to leaders through Board and committee presentations and discussions, as well as informal events and interactions with key talent throughout the year. Further, the Compensation and Leadership Development Committee periodically reviews the overall composition of the qualifications, tenure and experience of members of senior management. The Compensation and Leadership Development Committee reports on its succession planning efforts to the full Board, and the full Board reviews succession planning at least annually at a regularly scheduled Board meeting.

| 12 | 2017 Proxy Statement |  |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

In 2017, the full Board added specific talent management topics as standing agenda items at four out of six of its scheduled in-person meetings.

Process for Identifying and Evaluating Directors and Nominees

The Nominating and Corporate Governance Committee reviews with the Board, on an annual basis, the appropriate skills and qualifications required of Board members in the context of the then-current composition of the Board.members. The Committee also recommends to the Board the general criteria for selection of proposed nominees for election as Directors and the slate of individuals who will constitute the nominees of the Board for election as Directors at each Annual Meeting. In addition to qualities of intellect, integrity and judgment, this assessment by the Committee takes into consideration diversity, background, senior management experience and an understanding of some combination of marketing, finance, technology, international business matters, government regulation, public policy and the global capital and commodity markets. The Committee makes

this determination inevaluates the context of an assessmentskills and qualifications of the perceived needs of theexisting Board at that point in time.and potential candidates on a continuing basis.

The Board is responsible for selecting all members of the Board and for recommending such members for election by the shareholders. The Board delegates the screening process to the Committee with direct input from the Chairman of the Board or, if the Chairman is not an independent Director, the Presiding Director.Board. The Committee evaluates all nominees for Director based on the above criteria, including nominees recommended by shareholders. Although the Committee considers diversity as a factor in assessing the appropriate skills and qualifications required of Board members, the Board does not have a formal policy with regard to diversity in identifying Director nominees. The Committee has sole authority to retain and terminate search firms to assist the Board in identifying and reviewing prospective Director nominees and to approve the fees and other retention terms of any such search firms. In 2016, the Company engaged Spencer Stuart, a third-party director search firm, to identify and evaluate potential director candidates. Mr. Alverà, Ms. Hill, Ms. Leroux and Ms. Morris were identified and recommended to the Nominating and Corporate Governance Committee by Spencer Stuart.

Specific Experience, Qualifications, Attributes and Skills of Directors

The Nominating and Corporate Governance Committee has reviewed with the Board the specific experience, qualifications, attributes and skills of each Director nominee standing forre-election as a Director at this Annual Meeting. The Committee has concluded that each Director nominee has the appropriate skills and qualifications required of Board membership and that each possesses anin-depth knowledge of the Company’s complex global businesses and strategy. The Committee further believes that our Board is composed of well-qualified and well-respected Directors who are prominent in business, finance, and the global capital and commodity markets. The experience and key competencies of each Director nominee, as reviewed and considered by the Committee, are discussed on pages 1214 through 2325 of this Proxy Statement.

| | |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

The following 12 Director nominees are currently serving as Directors of the Company and have been nominated to stand forre-election at this Annual Meeting to serveone-year terms that will expire at the 20162018 Annual Meeting. Set forth below is information regarding each of the 12 Director nominees. Please see pages1 through6 and page84 96 of this Proxy Statement for voting information. Following each Director nominee’s biography below, we have highlighted certain notable skills and qualifications that the Nominating and Corporate Governance Committee reviewed and considered when recommending the Director nominee. Committee membership is identified for the one-year term expiring at the 2017 Annual Meeting.

| MARCO ALVERÀ | ||||

Director Since:

|

| |||

|

| |   |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

Board Committees: Compensation and Leadership Development (Chair) Nominating and Corporate Governance Executive |

| |||

William D. Green, age

| ||||

Skills and Qualifications We believe Mr. Green’s qualifications to sit on our Board of Directors and Chair our Compensation and Leadership Development Committee include his extensive leadership and management experience gained as the chief executive of a global professional services company providing a range of strategy, consulting, digital, technology and operations services and solutions and his deep understanding of the information technology industry. |

| | |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

Director Since:2012

Board Committees:

| CHARLES E. HALDEMAN, JR. | |||

Charles E. Haldeman, Jr., age

| ||||

|

| |   |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

Board Committees: Financial Policy | STEPHANIE C. HILL | |||

Stephanie C. Hill, age 52, is Vice President and General Manager of Lockheed Martin’s Cyber, Ships & Advanced Technologies (CSAT) line of business for Rotary and Mission Systems. Ms. Hill serves as chair of the Greater Baltimore Committee and is a member of the University of Maryland, Baltimore County’s Board of Visitors. Additionally, she sits on the Boards of Directors of the U.S. Coast Guard Foundation and Project Lead the Way, the nation’s leading provider ofK-12 Science, Technology, Engineering and Mathematics (STEM) programs. Ms. Hill has been recognized for her career achievements and community outreach, especially in the advancement of STEM education. She was recognized as one of Computerworld’s 2015 Premier 100 IT Leaders and one of Maryland’s 19th Annual International Leadership Awardees by the World Trade Center Institute. In 2014, Ms. Hill was named the U.S. Black Engineer of the Year by Career Communications Group and included on Ebony Magazine’s Power 100 list, recognizing the achievements of African-Americans in a variety of fields. | ||||

We believe Ms. Hill’s qualifications to sit on our Board of Directors include her exceptional and consistent business and community leadership and technical experience, as well as her experience working with the government on issues of critical importance and her leadership in corporate governance. |

| 2017 Proxy Statement | 17 |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

Director Since:2014

Board Committees:

| REBECCA JACOBY | |||||

Rebecca Jacoby, age

|

|

| ||||

|

| |   |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

Board Committees: Audit | MONIQUE F. LEROUX | |||

Monique F. Leroux, age 62, is President of the International Cooperative Alliance (ICA), representing the cooperative movement in more than 100 countries. From March 2008 to April 2016, Ms. Leroux was the Chair of the Board, President and Chief Executive Officer of Desjardins Group, the leading cooperative financial group in Canada. Before joining Desjardins Group in 2001, Ms. Leroux held positions as the Chief Operating Officer at Québecor Inc., Senior Vice President of Finance and Senior Vice President Quebec at RBC (Royal Bank) and Partner at Ernst & Young. Ms. Leroux serves on the Boards of Alimentation Couche-Tard, Michelin, Crédit Mutuel/CIC and BCE/Bell. Ms. Leroux serves as Chair of the Board of Investissement Québec, nominated by the Quebec Government in April 2016. She is also Chair of the Quebec Economic and Innovation Council and chairs the High Level Contact Group of the European Association ofCo-operative Banks (EACB). She is the founder and Chair of the International Summit of Cooperatives and chairs the Board of Governors of the Society for the Celebrations of Montreal’s 375th anniversary. Ms. Leroux is also a member of the Order of Canada and the Canadian Prime Minister’s Advisory Committee on the Public Service, the Business Council of Canada, the Founders’ Council of the Quebec Global 100 Network and the Asia Business Leaders Advisory Council. She is an Officer of the Ordre National du Québec and a Chevalier of the Légion d’Honneur (France). She is also the recipient of the Woodrow Wilson Award (United States), the Outstanding Achievement Award from the Quebec CPA Order and the Institute of Corporate Directors Fellowship Award. She holds honorary doctorates from eight Canadian universities. | ||||

We believe Ms. Leroux’s qualifications to sit on our Board

| ||||

|

| | |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

Director Since:2016 Board Committees: Audit | MARIA R. MORRIS | |||

Maria R. Morris, age 54, is Executive Vice President, MetLife, Inc., a member of MetLife’s Executive Group and leads MetLife’s Global Employee Benefits (GEB) business. She also is the interim Head of MetLife’s U.S. Business. In her role leading MetLife’s GEB business since 2012, Ms. Morris is responsible for expanding MetLife’s employee benefits business in more than 40 countries, broadening relationships and fueling growth across the globe via local solutions and partnerships with multinational corporations as well as through distribution relationships with financial institutions. In her interim role as Head of the U.S. Business she leads MetLife’s Retirement Income Solutions, Group Benefits, Holdings, Property & Casualty; and U.S. Direct businesses. Ms. Morris joined MetLife in 1984, and has since held a number of senior leadership roles. Ms. Morris serves on the Boards of Directors of MetLife Property and Casualty Insurance Company, the MetLife Foundation and the American Council of Life Insurers. She is also a member of the Board of Trustees for the Catholic Charities Archdiocese of New York and is Vice Chair of the All Stars Project, Inc. | ||||

Skills and Qualifications We believe Ms. Morris’s qualifications to sit on our Board of Directors include her executive leadership and management experience in the financial services industry, her technology expertise and her experience in growing a multinational company in more than 40 countries. |

| 20 | 2017 Proxy Statement |  |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

Director Since:2013

President and Chief Executive Officer

Board Committees:

| DOUGLAS L. PETERSON | |||

Douglas L. Peterson, age Mr. Peterson was elected President and CEO effective November Previously, Mr. Peterson was the Chief Operating Officer of Citibank, N.A., Citigroup’s principal banking entity that operates in more than 100 countries. Mr. Peterson was with Citigroup for 26 years, during which time he transformed businesses and drove performance in investment and corporate banking, brokerage, asset management, private equity and retail banking. His prior roles include CEO of Citigroup Japan, Country Manager for Costa Rica and Uruguay and Chief Auditor of Citigroup. Mr. Peterson is a steward of the World Economic Forum’s Global Strategic Infrastructure Initiative andco-chairs the Bipartisan Policy Center’s CEO Council on Infrastructure. He serves on

| ||||

As |

| 2017 Proxy Statement | 21 |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

Board Committees: Audit (Chair) Executive Financial Policy |  |

| SIR MICHAEL RAKE | ||||

| ||||

Sir Michael Rake, age

| ||||

Skills and Qualifications We believe Sir Michael’s qualifications to sit on our Board of Directors and Chair our Audit Committee include his executive leadership and management experience, his expertise in financial accounting and corporate finance, his extensive international business experience and his overall knowledge of global markets. |

| 22 | 2017 Proxy Statement |  |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

|

Director Since:2001

Corporate Governance (Chair)

Leadership Development

| EDWARD B. RUST, JR. | |||

Edward B. Rust, Jr., age | ||||

Skills and Qualifications

|

| 2017 Proxy Statement | 23 |

|

Board Committees: Nominating and Corporate Governance Compensation and Leadership Development |  |

| KURT L. SCHMOKE | ||||

| ||||

Kurt L. Schmoke, age

|

|

| ||||

|

| |   |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

Board Committees: Audit Financial Policy (Chair) Executive |

| |||

Richard E. Thornburgh, age

| ||||

Skills and Qualifications We believe Mr. Thornburgh’s qualifications to sit on our Board of Directors and Chair our Financial Policy Committee include his financial expertise, his extensive experience in the global financial services industry and his familiarity with strategic transactions acquired through executive-level positions in investment banking and private equity. |

| | |

Corporate Governance Materials

The following corporate governance materials are available and can be viewed and downloaded from the Corporate Governance section of the Company’s Investor Relations Website at http://investor.mhfi.com: (i) the Company’s Amended and Restated Certificate of Incorporation; (ii) the Company’s By-Laws; (iii) the Company’s Corporate Governance Guidelines; (iv) Board Committee Charters for the Company’s Audit, Compensation and Leadership Development, Executive, Financial

Policy and Nominating and Corporate Governance Committees; (v) the Code of Business Ethics applicable to all Company employees; (vi) the Code of Ethics applicable to the Company’s Chief Executive Officer and Senior Financial Officers; (vii) the Code of Business Conduct and Ethics for Directors applicable to all the Company’s Directors; and (viii) the Audit Committee’s Policy concerning Employee Complaint Procedures Regarding Accounting and Auditing Matters.

| BOARD OF DIRECTORS AND CORPORATE GOVERNANCE (continued) |

Committees of the Board of Directors

The Company has standing Nominating and Corporate Governance, Audit, and Compensation and Leadership Development Committees. The Chair of each Committee reports to the full Board as appropriate from time to time. Each Committee has a Charter that is reviewed by the Nominating and Corporate Governance Committee on a regular basis. In addition to these three standing Committees, the Board has an Executive Committee and a Financial Policy Committee. A brief description of the Nominating and Corporate Governance, Audit and Compensation and Leadership Development Committees follows.

Nominating and Corporate Governance Committee

The functions performed by the Nominating and Corporate Governance Committee include, among other matters:

recommending to the Board the general criteria for selection of Director nominees and evaluating possible candidates to serve on the Board;

recommending to the Board appropriate compensation to be paid to Directors;

determining whether any material relationship between a non-managementnonmanagement Director and the Company might exist that would affect that Director’s status as independent;

making recommendations, from time to time, to the Board as to matters of corporate governance and periodically monitoring the Board’s performance; and

reviewing with the Board succession plans for the Chief Executive Officer and the direct reports to the Chief Executive Officer.

Additional information about the Nominating and Corporate Governance Committee follows:

The Committee has a Charter whichthat can be viewed and downloaded from the Corporate Governance section of the Company’s Investor Relations Websitewebsite at http://investor.mhfi.com.investor.spglobal.com.

All current members of the Committee are independent as defined in the rules of the New York Stock Exchange.NYSE.

The Committee will consider nominees for Director recommended by shareholders. If a shareholder wishes to recommend a candidate for Director, the shareholder should submit a written nomination to the Nominating and Corporate Governance Committee by sending it to the Corporate Secretary, c/o Office of the General Counsel, McGraw Hill Financial, Inc., 55 Water Street, New York, New York 10041-0003. In general, a shareholder wishing to nominate a Director at an Annual Meeting must deliver written notice of the nomination to the Corporate Secretary no earlier than 120 days and no later than 90 days prior to the first anniversary of the preceding year’s Annual Meeting. The notice must: (a) set forth the name and address of the nominating shareholder, the number of shares owned by such shareholder, and any other information relating to such shareholder that would be required to be disclosed in a Proxy Statement in connection with a contested election for Directors pursuant to Section 14 of the Securities Exchange Act of 1934 (the “Exchange Act”); (b) set forth all information relating to the Director nominee that would be required to be disclosed in a Proxy Statement in connection with a contested election for Directors pursuant to Section 14 of the Exchange Act (including such person’s consent to being named as a nominee and to serving as a Director if elected), and a description of all compensation and other material relationships between the nominating shareholder and the Director nominee; and (c) include a completed questionnaire, representation and agreement signed by the Director nominee, copies of which may be obtained from the Company’s Secretary. These requirements are more fully described in the Company’s By-Laws. The By-Laws can be viewed and downloaded from the Corporate Governance section of the Company’s Investor Relations Website at http://investor.mhfi.com.

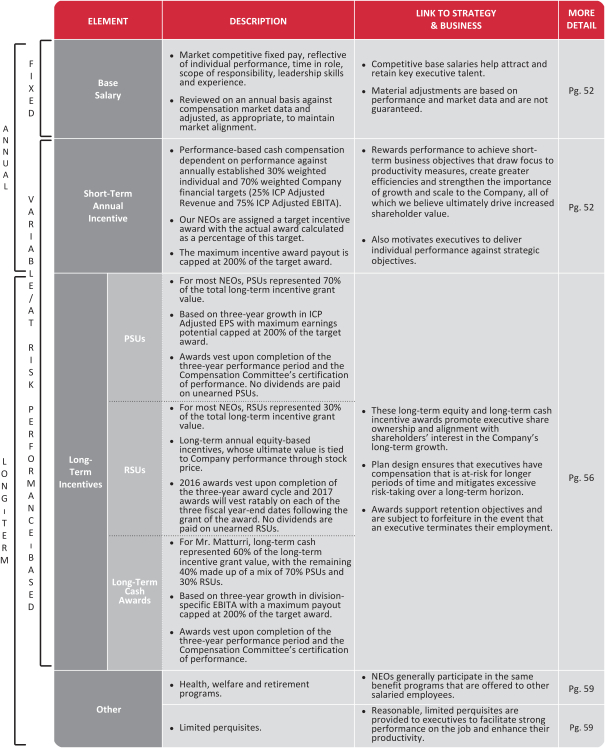

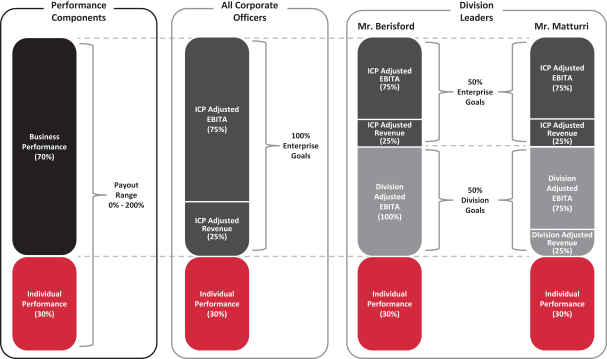

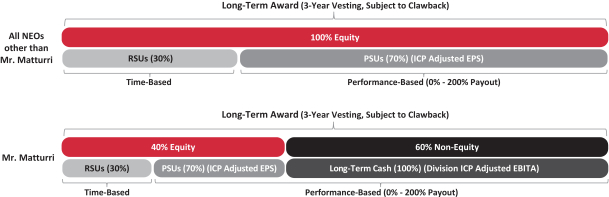

|